What are the impacts of an increased global trade of green iron on global steel production?

In the trade scenarios, 12-21% of global crude steel is produced from traded green iron in 2050. 15-26 Mt/a of hydrogen consumption is relocated to global “sweet spots”, resulting in cost savings of 2.2-3.9% of the global annual steel production costs, which can provide important support for the development of net zero steel production.

The magnitude of green iron imports varies across scenarios. The volume of green iron imports into the EU 27, Japan and South Korea reaches 95 Mt/a by 2050 and is assumed to take place equally in both trade scenarios. The global green iron trade volume is contingent upon the assumptions made regarding the import volumes of other HBI-importing regions (see section 2.3). In the Intermediate Trade and Max Trade scenarios, the global green iron trade volume reaches 240 Mt/a and 430 Mt/a, respectively, by 2050. In relation to the global green iron production, which is 590 Mt/a in 2050 in both scenarios, 39% and 73% of green iron production is traded in 2050 in the Intermediate Trade and Max Trade scenarios, respectively.

You can explore below the resulting production volumes for the world and key regions and countries.

Steel production

The chart will present the steel production results.

Loading...

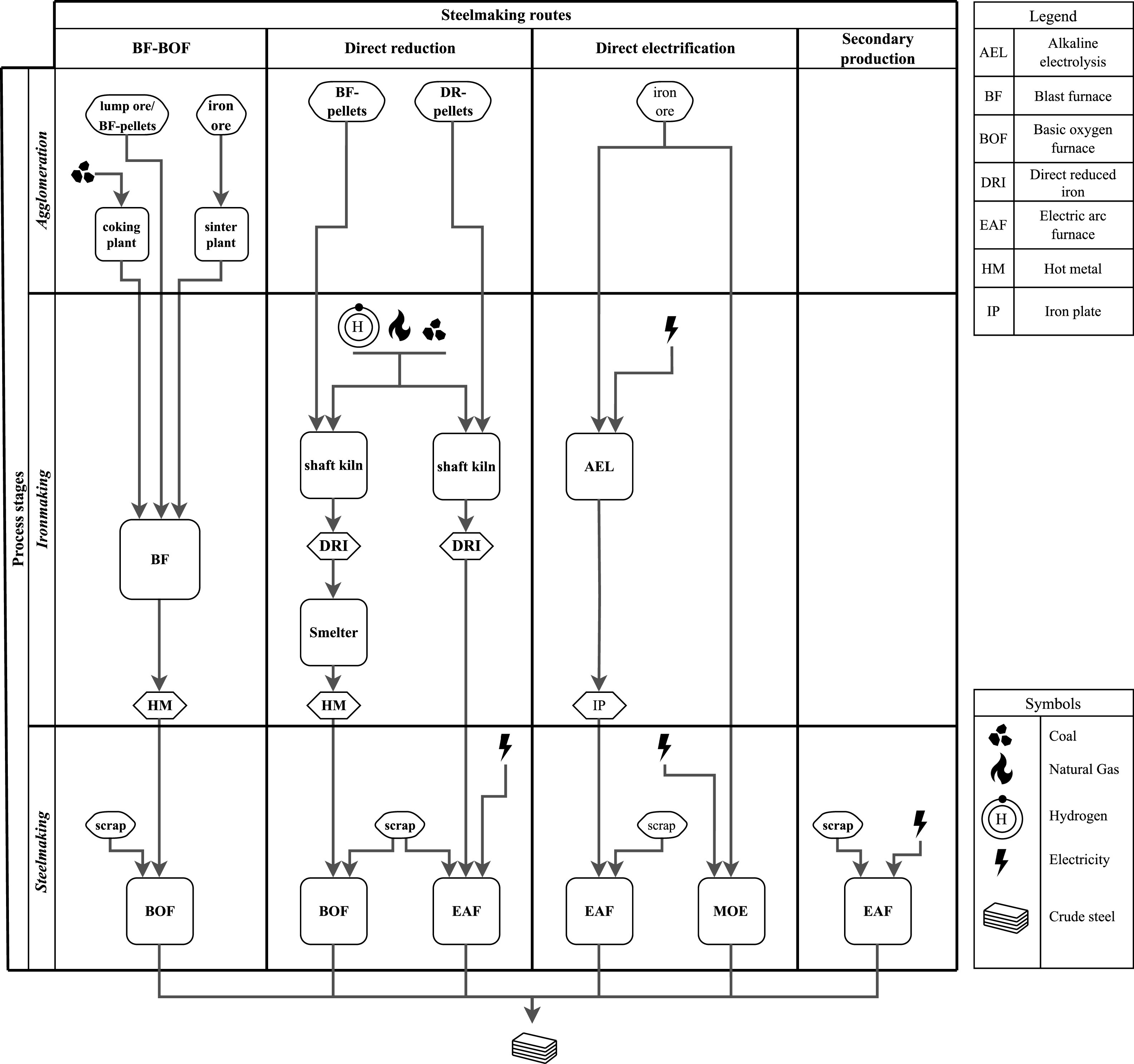

- The Domestic scenario is a synthesis of existing regional climate neutrality scenarios and roadmaps for CS production. As the studies and roadmaps underlying the scenario foresee a mix of mitigation options, conventional primary production with/without CCS, direct electrification and increased secondary steelmaking using scrap are the mitigation options included in the technology path of the Domestic scenario in addition to the DRI path.

- The Intermediate Trade and Max Trade scenarios are identical to the Domestic scenario except for global green iron trade, starting in the late 2020s. The mix of technology routes in these scenarios is hence kept identical to the Domestic scenario. Today's major iron ore exporting countries (Australia, Brazil, South Africa) are assumed to become exporters of green iron, and steel producing countries with higher hydrogen production costs become importers of green iron. The exporting countries are not only rich in iron ore, but also have particularly low costs for renewable electricity production, making them ideal candidates for H2-DRI production and its export.

What are the impacts on the CO2 emissions of the steel sector?

The synthesis of regional technology pathways for CS production implies a significant technology shift in global CS production by 2050, with a similar technology split in all three scenarios. The share of secondary production increases from 400 Mt/a in 2020 to 900 Mt/a in 2050, indicating an increase of the scrap share in CS production from 39 % in 2020 to 60 % in 2050. CS production from the BF-BOF route decreases from 1350 Mt/a in 2020 to 350 Mt/a in 2050 with only 10 Mt/a left producing without CCS. Another important aspect of the scenarios is the share of steel production via DRI, which increases from 93 Mt/a in 2020 to more than 700 Mt/a in 2050.

As defined by the scenario design, the trade scenarios differ from the Domestic scenario precisely in the location of H2-DRI production. By 2050, 570 Mt/a of CS are produced with H2-DRI in total, whereof 230 Mt/a and 415 Mt/a are produced from imported DRI in the Intermediate Trade and Max Trade scenarios, respectively. Hence, the scenarios do not differ in CO2 emissions. All three scenarios achieve near-zero emissions in 2050 and imply cumulative CO2 emissions of 51 Gt between 2020 and 2050.

You can explore below the resulting emissions from the steel production.

CO2 emissions - Steel production

The chart will present the CO2 emissions for steel generation.

Loading...

- The Domestic scenario is a synthesis of existing regional climate neutrality scenarios and roadmaps for CS production. As the studies and roadmaps underlying the scenario foresee a mix of mitigation options, conventional primary production with/without CCS, direct electrification and increased secondary steelmaking using scrap are the mitigation options included in the technology path of the Domestic scenario in addition to the DRI path.

- The Intermediate Trade and Max Trade scenarios are identical to the Domestic scenario except for global green iron trade, starting in the late 2020s. The mix of technology routes in these scenarios is hence kept identical to the Domestic scenario. Today's major iron ore exporting countries (Australia, Brazil, South Africa) are assumed to become exporters of green iron, and steel producing countries with higher hydrogen production costs become importers of green iron. The exporting countries are not only rich in iron ore, but also have particularly low costs for renewable electricity production, making them ideal candidates for H2-DRI production and its export.

More details

You can find more details on the study in a paper published in the Energy and Climate Change journal:

Bilici, S., Holtz, G., Jülich, A., König, R., Li, Z., Trollip, H., Call, B. M., Tönjes, A., Vishwanathan, S. S., Zelt, O., Lechtenböhmer, S., Kronshage, S., & Meurer, A. (2024). Global trade of green iron as a game changer for a near-zero global steel industry? - A scenario-based assessment of regionalized impacts. Energy and Climate Change, 5, 100161. https://doi.org/10.1016/j.egycc.2024.100161

A detailed visualiser of all data is available here.